Step-By-Step: How to Acquisition a Reverse Home Mortgage With Confidence

Navigating the complexities of buying a reverse home loan can be complicated, yet an organized approach can empower you to make educated choices. It starts with examining your qualification and understanding the subtleties of numerous funding choices readily available in the market (purchase reverse mortgage). As we explore each step, it becomes evident that confidence in this economic choice hinges on complete prep work and educated choices.

Comprehending Reverse Home Mortgages

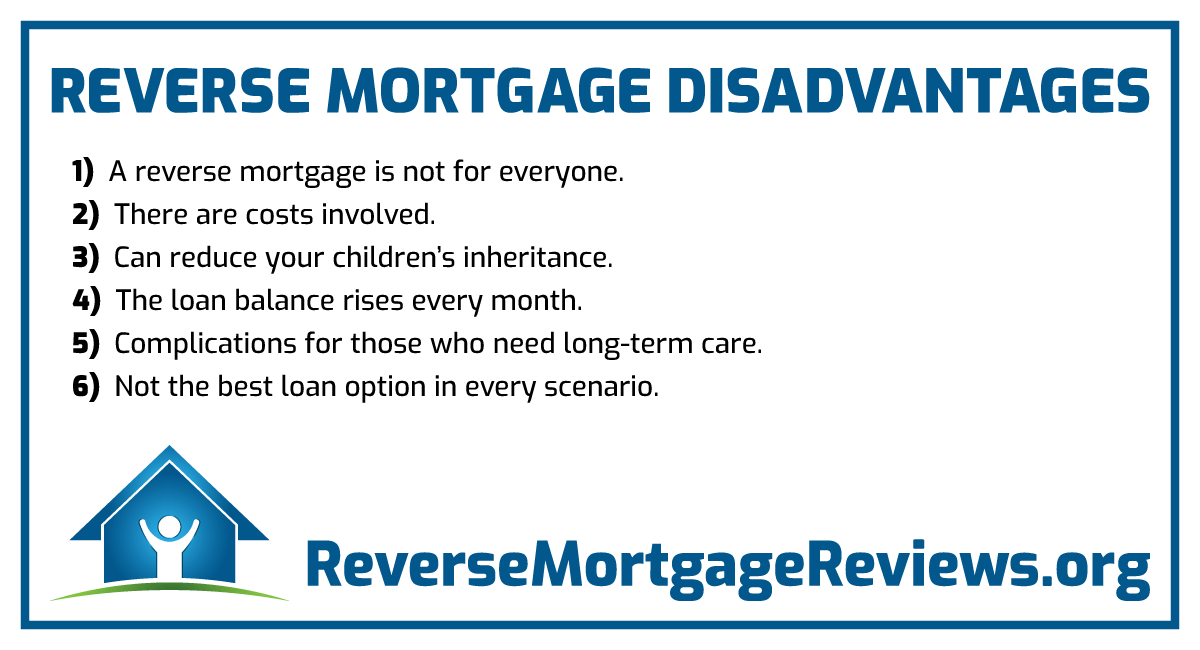

The primary system of a reverse mortgage entails loaning against the home's value, with the loan quantity enhancing in time as interest accrues. Unlike conventional home mortgages, consumers are not needed to make month-to-month repayments; rather, the funding is paid off when the house owner offers the home, vacates, or passes away.

There are two primary sorts of reverse home loans: Home Equity Conversion Home Loans (HECM), which are government guaranteed, and proprietary reverse home loans used by exclusive loan providers. HECMs usually supply greater security due to their regulative oversight.

While reverse mortgages can offer economic alleviation, they also include costs, consisting of origination charges and insurance coverage premiums. It is crucial for potential customers to fully recognize the terms and effects prior to proceeding with this financial option.

Analyzing Your Eligibility

Eligibility for a reverse home mortgage is largely established by numerous vital aspects that prospective borrowers have to think about. Primarily, applicants need to be at least 62 years of age, as this age requirement is set to make sure that borrowers are coming close to or in retirement. In addition, the home must serve as the customer's primary residence, which means it can not be a trip or rental residential or commercial property.

Another important aspect is the equity placement in the home. Lenders commonly call for that the customer has an enough quantity of equity, which can impact the quantity available for the reverse home mortgage. Normally, the much more equity you have, the larger the funding quantity you might get.

Furthermore, prospective consumers must demonstrate their ability to meet monetary responsibilities, consisting of real estate tax, homeowners insurance, and upkeep costs - purchase reverse mortgage. This assessment usually includes an economic assessment performed by the loan provider, which evaluates earnings, credit scores history, and existing debts

Lastly, the home itself have to satisfy certain standards, including being single-family homes, FHA-approved condos, or particular manufactured homes. Understanding these aspects is important for determining eligibility and getting ready for the reverse mortgage process.

Investigating Lenders

After determining your eligibility for a reverse mortgage, the next action involves investigating lenders who provide these More Help monetary products. It is vital to recognize reputable lending institutions with experience backwards home loans, as this will guarantee you receive reliable support throughout the procedure.

Begin by assessing lending institution credentials and certifications. Try to find loan providers that are participants of the National Opposite Home Mortgage Lenders Organization (NRMLA) and are accepted by the Federal Real Estate Administration (FHA) These affiliations can indicate a dedication to honest practices and compliance with industry requirements.

Reviewing customer evaluations and endorsements can supply understanding into the lending institution's credibility and client service high quality. Web sites like the Better Service Bureau (BBB) can additionally use rankings and problem histories that might aid inform your decision.

Furthermore, seek advice from monetary advisors or housing counselors who focus on reverse home mortgages. Their expertise can assist you navigate the options readily available and recommend credible lending institutions based on your special monetary scenario.

Comparing Funding Options

Contrasting loan options is a critical action in safeguarding a reverse home loan that lines up with your financial goals. When evaluating numerous reverse home mortgage products, it is necessary to consider the details attributes, expenses, and terms connected with each choice. Begin by reviewing the type of reverse home mortgage that best matches your requirements, such as Home Equity Conversion Mortgages (HECM) or proprietary car loans, which may have various eligibility standards and advantages.

Next, pay focus to the rate of interest and fees related to each lending. Fixed-rate car loans offer security, while adjustable-rate choices might provide lower first rates look at this website but can change in time. Additionally, think about the upfront costs, consisting of mortgage insurance coverage costs, source costs, and closing expenses, as these can considerably impact the overall expenditure of the loan.

Additionally, analyze the payment terms and just how they line up with your long-term monetary approach. When the lending need to be paid back is essential, understanding the effects of how and. By thoroughly comparing these elements, you can make a notified choice, ensuring your selection sustains your economic well-being and offers the safety and security you seek in your retirement years.

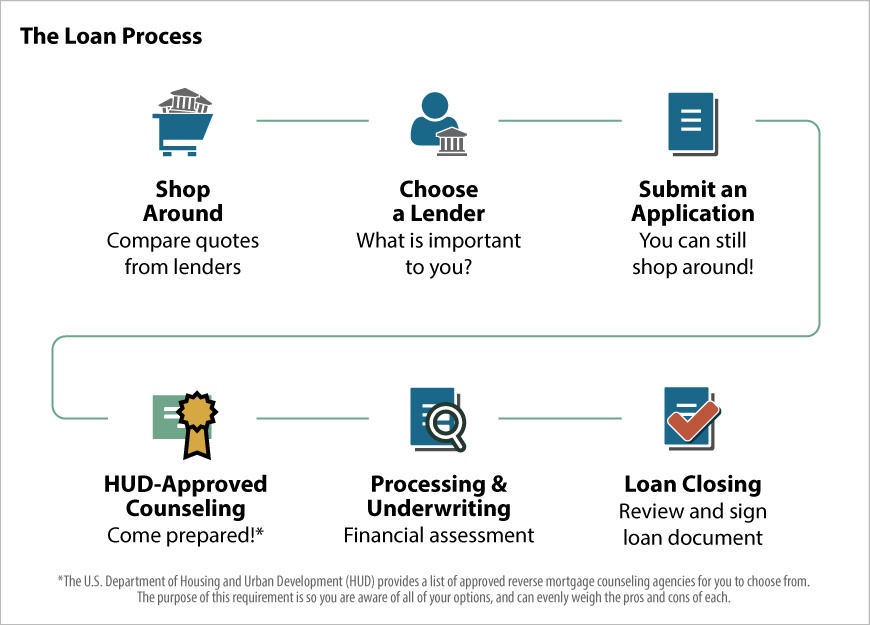

Finalizing the Acquisition

As soon as you have actually very carefully assessed your options and chosen the most appropriate reverse mortgage item, the following step is to wrap up the acquisition. This process entails a number of important actions, guaranteeing that all required paperwork is properly completed and submitted.

First, you will require to collect all called for documentation, including proof of revenue, building tax obligation declarations, and home owners insurance paperwork. Your lender will certainly provide a list of specific documents needed to promote the approval process. It's vital to offer accurate and complete info to stay clear of delays.

Next, you will undergo a comprehensive underwriting procedure. During this stage, the loan provider will certainly assess your monetary circumstance and the worth of your home. This might include a home assessment to identify the property's market price.

Once underwriting is complete, you will certainly get a Closing Disclosure, which outlines the final terms of the funding, consisting of fees and rates of interest. Testimonial this paper meticulously to make certain that it straightens with your assumptions.

Conclusion

To conclude, browsing the process of purchasing a reverse home loan needs a thorough understanding of qualification criteria, persistent study on lending institutions, and cautious contrast of funding options. By systematically adhering to these steps, individuals can make enlightened decisions, guaranteeing that the picked home loan lines up check this with monetary goals and demands. Eventually, an educated strategy fosters confidence in protecting a reverse mortgage, giving financial security and assistance for the future.

Look for lenders who are participants of the National Opposite Home Loan Lenders Association (NRMLA) and are accepted by the Federal Real Estate Administration (FHA)Comparing car loan alternatives is a vital step in securing a reverse mortgage that straightens with your financial objectives (purchase reverse mortgage). Start by assessing the kind of reverse home mortgage that finest suits your requirements, such as Home Equity Conversion Home Mortgages (HECM) or proprietary lendings, which may have different eligibility requirements and benefits

In final thought, browsing the procedure of acquiring a reverse mortgage requires a thorough understanding of eligibility standards, attentive research on loan providers, and cautious comparison of lending options. Eventually, a well-informed technique promotes confidence in protecting a reverse mortgage, offering financial security and assistance for the future.